Frequently Accessed Pages

Effort Commitments and Payroll Certification

RAMP - Frequently Asked Questions (FAQ)

No-Cost Extension Request Procedures

Extramural Support Policies and Procedures

Research Education Development (RED)

Award Statistics FY23

Total Awards

$1928M

Federal Awards

$1125M

Non-Federal Awards

$803M

Research Expenditures

8th (FY22)

DHHS Salary Cap Guidance

Page Updated: June 24, 2024

Overview

Departments are responsible for ensuring compliance with any salary limitations imposed by sponsors. None of the grant, cooperative agreements, or contract funds may be used to pay the salary of an individual at a rate in excess of the applicable salary cap on any project funded by Health and Human Services agencies. This page serves as guidance to assist departments in complying with these requirements.

The restriction to cap the amount of salary that can be paid to an individual from an HHS award is due to a legislatively mandated provision for the limitation of salary costs. Links to the notices providing detailed information about the limitation and a list of rates is available on the NIH Salary Cap Summary page. Please refer to this page to determine what rate is in effect for an award at a specific time.

The dollar amount of the award payment is irrelevant, as any value has cap implications if the employee’s salary rate is above the applicable cap. Every dollar of effort is comprised of an allowable salary payment directly charged to the award and the required salary cap cost share.

The consistent message from auditors and the NIH Policy Office is that the corresponding salary cap cost sharing must be available in the same pay period that the salary payment is directly charged and must be paid from institutional funds. It is not permissible to cross over to different pay periods to fulfill the salary cap cost sharing requirement to stay in compliance. Monitoring of the cap must occur on a pay period basis to ensure a sufficient amount of salary is being paid from non-sponsored sources.

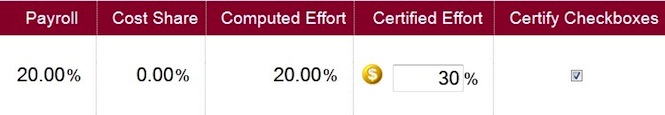

Ultimately, the effort certification is the means to confirm that the salary cap cost share portion has been adequately linked to the award. The amount certified over the payroll figure is treated as implied cap cost share.

Applications / Proposals

COGR document, page 36, explains how an institution must handle a request for salary support (in a proposal) if the individual's base salary is greater than the sponsor's ceiling.

Proposals Requiring Detailed Budget

Award applications that include a detailed budget in the proposal should reflect the actual institutional base salaries for all individuals for whom funding is requested. NIH staff will make the necessary adjustments to requested salaries prior to issuing an award. Alternatively, applicants may provide an explanation indicating that the actual institutional base salary exceeds the current salary cap, and request dollars calculated on the cap amount (as described below for modular budgets).

Proposals Using Modular Budgets and SNAP Applications

For modular applications, and streamlined non-competing continuation applications (SNAP), the current cap rate should be used for calculating salary for any individual whose University rate exceeds the cap. For instance, if Professor X has UW salary rate of $200,000, and proposes that she spend 50% of her effort on the project proposed to begin during federal fiscal year 2012, she should refer to the NIH summary page to find that the FY12 cap is $179,700 and request 50% of $179,700, or $89,850 plus fringe benefits costs for that position.

Please also be aware at the time of proposal that the amount exceeding the cap will need to be paid from a non-sponsored source having no restriction that would preclude the payment of costs associated with the NIH-funded project. In the example above, at least $10,150 of Professor X’s salary will need to be paid from a non-sponsored source and the amount will be identified as “salary cap cost sharing” toward the project.

Planning Payroll

Payroll Staff Affected by the Cap When Proposals are Funded

Prior to arranging to payroll the salary on a new or continuation award, the department should determine in which federal fiscal year the award was made. The "issue date" indicated near the top of the Notice of Award determines the fiscal year. The federal fiscal year runs from October 1st through September 30th. Once you have determined which fiscal year funding will be used, you may refer to the NIH Salary Cap Summary page to determine the actual salary cap in effect for your award.

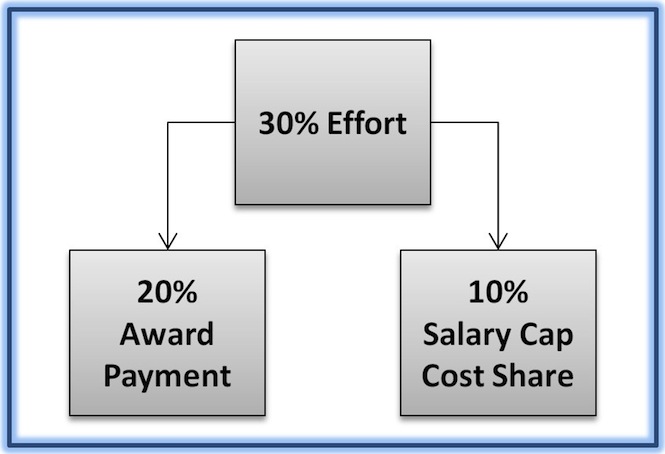

The key to managing the cap is to know the splits for the allowable award and salary cap cost share portions. Regardless of the figure that gets plugged in for effort, the ratios remain the same.

Allowable Award Payment Ratio:

Effort * Applicable Cap / FTE RateCap Cost Share Ratio:

Effort * (1 - (Applicable Cap / FTE Rate))It is important to maintain the right balance of award payments and required salary cap cost share for the level of effort being devoted. The following diagram illustrates the relationship between all three variables and shows the proper balance (i.e. correct splits):

Applicable Cap: $179,700 | FTE Rate: $269,550 | Effort: 30%

Certifying Effort

The certified amount on the effort report is the confirmation that the required cap cost share was counted as effort on the award. The certification ties the non-sponsored salary to the award. The amount certified over the payroll figure is treated as implied cap cost share. Please note that the cost share is not documented in the cost sharing system, as the salary cap overage is an unallowable cost on the award.

Applicable Cap: $179,700 | FTE Rate: $269,550 | Effort: 30%

In situations where the payroll percentage on the effort report isn't as planned (e.g. fluctuating effort or award start date is in the middle of the effort reporting period), use the following multiplier to assist in determining the required effort in relation to the payroll charged to the award:

Cap Certifier Multiplier:

FTE Rate / Applicable CapIn the example above, if only 10% of payroll was charged to the award for the six month snapshot (i.e. fluctuating effort), the employee over the cap must have 15% of certified effort.

Rounding the certified effort figure to nearest integer is generally acceptable, even if it means rounding down. An exception is for individuals whose salaries exceed the DHHS Salary Cap. In some cases, rounding down fails to demonstrate salary cap compliance, as an insufficient amount of implied cap cost share will be credited in the monitoring report. In these situations, individuals should round up to the nearest integer to properly document the implied salary cap cost share.

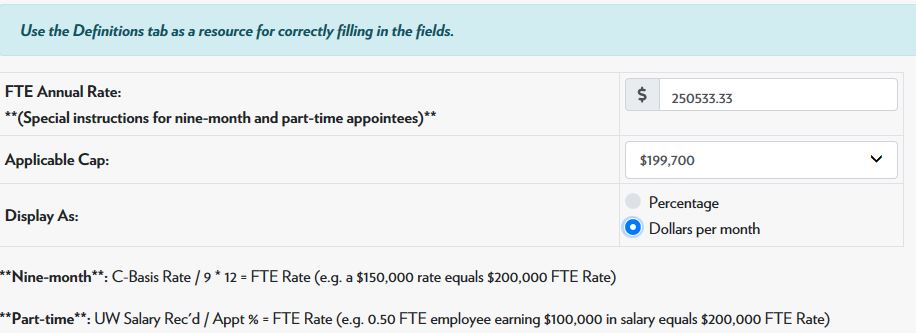

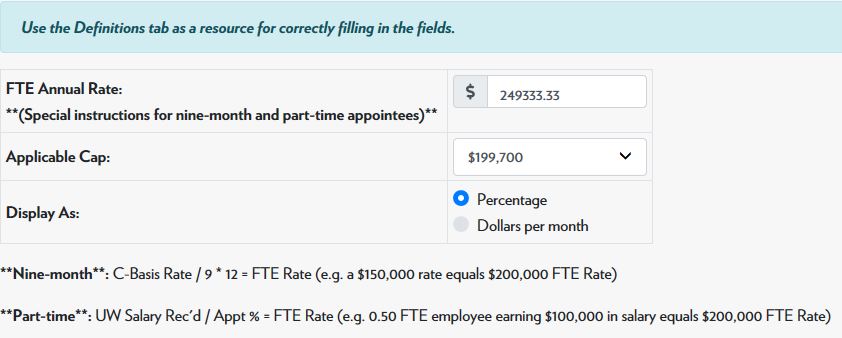

| FTE Annual Rate: **(Special instructions for nine-month and part-time appointees)** |

|

|---|---|

| Applicable Cap: | |

| Display As: |

|

**Nine-month**: C-Basis Rate / 9 * 12 = FTE Rate (e.g. a $150,000 rate equals $200,000 FTE Rate)

**Part-time**: UW Salary Rec'd / Appt % = FTE Rate (e.g. 0.50 FTE employee earning $100,000 in salary equals $200,000 FTE Rate)

Salary Cap Worksheet

The worksheet below will help you determine what may be charged to the award on a pay period basis, and what amount must be cost-shared from a flexible, non-sponsored source.

Effort (in %)

=

Award Payment (in %)

+

Required Cap Cost Share (in %)

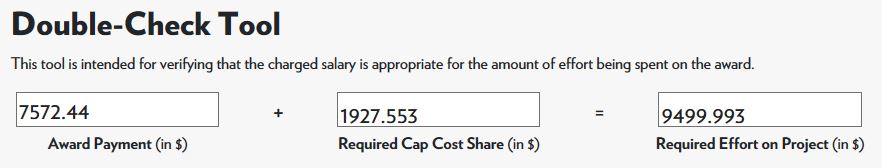

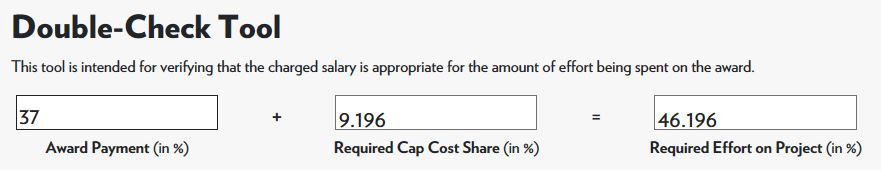

Double-Check Tool

This tool is intended for verifying that the charged salary is appropriate for the amount of effort being spent on the award.

Award Payment

(in %)

+

Required Cap Cost Share

(in %)

=

Required Effort on Project

(in %)

For individuals with multiple funding sources, please use the attached excel spreadsheet to determine your payroll splits.

Corrections

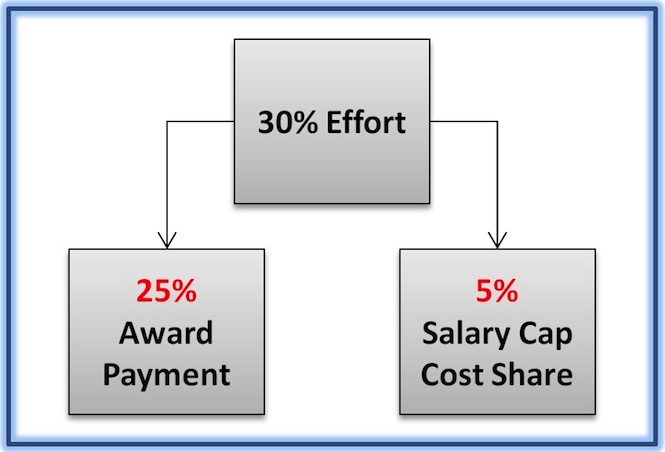

Instances may come up that call for corrective action in the form of processing salary transfers. What this achieves is to correct the imbalance in the ratios in order to show cap compliance.

The diagram directly below represents an imbalance in the ratios:

Applicable Cap: $179,700 | FTE Rate: $269,550 | Effort: 30%

30% effort must be comprised of 20% award payment and 10% salary cap cost share. Transferring off 5% award payment to non-sponsored funding, which in turn automatically gets counted as additional salary cap cost share, achieves equilibrium. RSP has developed a report to monitor management of the salary cap.

Definitions/Terminology

FTE Rate: the Full-Time Equivalent Salary Rate associated with payroll records in the HRS database. Nine-month and part-time appointees must be converted to a full-time annual rate.

The following examples both represent a $200,000 FTE Rate with respect to salary cap calculations:

- $150,000 nine-month "c-basis" rate (150,000 / 9 * 12)

- 50% appointee receiving $100,000 in salary (100,000 / 0.50)

Applicable Cap: the effective salary limitation of the award. It's tied to the Federal Executive Pay Scale and the capped amount may change for each budget period of the award.

Effort: Research effort requested in the application/proposal. The commitment is usually made in person-months (e.g. 3.6 mos.). Expressing the effort as a dollar amount, percentage, or person-month is synonymous.

Cap Certifier Multiplier: FTE Rate / Applicable Cap

Allowable Award Payment Ratio: Effort * Applicable Cap / FTE Rate

Cap Cost Share Ratio: Effort * (1 - (Applicable Cap / FTE Rate))

FAQs

What is the Salary Cap?

A legislatively-mandated provision limiting the direct salary (also known as salary or institutional base salary, but excluding any fringe benefits and F&A costs) for individuals working on DHHS awards (including grants, cooperative agreement, and contracts). The salary limitation rate applies to any individual whose salary is charged directly to awards from these agencies.

Who sets the rate?

The rates are set by Congress as part of the annual federal budget appropriations process. The Federal Executive Pay scale may change each year with an effective date sometime in January.

How do I know which salary cap rate to use?

When using this chart you need to focus on which Executive Level was in effect when the award was issued. Keep in mind that the Executive Level and/or the amount of salary at that level can change from year to year. For example, if your award was issued in August 2011, it would be under Executive Level I ($199,700) and stay at that level until a new Notice of Award is issued. If your award was issued in August 2012, it would be under Executive Level II.

How is the salary cap applied?

The cap establishes a maximum annual rate of pay at which an individual’s full time effort over a twelve-month period can be charged on a DHHS award. It is not intended to limit the actual salary paid by the institution. An institution may pay an individual in excess of the salary cap, and any excess must be paid from non-sponsored funds. The cap is a limitation that not only applies annually, but that must be monitored on a pay period basis. The cap, therefore, dictates the amount that can be charged to a DHHS award any given pay period.

How do I determine the amounts that can be charged to the award and to non-sponsored funds?

An example:

The 2011 NIH salary cap was $199,700 ($16,641.67 * 12 months).

The PI on a DHHS award has a nine-month appointment with an FTE rate of $187,900.

To calculate the necessary salary cap cost share, the UW converts 9-month appointment to 12-month.

$187,900/9*12 = $250,533.33. Even though their FTE 9 month appointment is less than the $199,700 cap, they are over the cap on an annual basis and must provide cap cost share.

The PI’s FTE monthly rate is $20,877.77. He/she is paid 45% or $9,500 each month for his/her effort on a DHHS award.

The calculation is:

($199,700/$250,533.33)* $9,500 =$7,572.45. $7,572.45 can be paid from the DHHS award, and $1,927.55 non-sponsored funds are needed for cap cost share.

The calculation can be verified by clicking on the Tools tab above.

The excess amount above the salary cap must be covered using non-sponsored funds.

How is the salary cap applied to a nine-month appointee?

Salary cap levels are based on 12 months. For 9-month appointments, the salary level must be converted to 12 months. See the Tools tab above for special instructions for nine-month appointees.

What if my salary is above the salary cap?

You will need to work with your payroll office to make sure that salary charged to cover your effort on DHHS awards is properly split between DHHS sponsored funds and UW Madison non-sponsored funds. Use the Tools tab above to figure out how much can be charged to the DHHS award and how much must be charged to non-sponsored funding.

Can salaries subject to the DHHS cap be supplemented?

Yes. Actual salary paid to an individual is not constrained by the salary cap. Only the salary charged to sources that are subject to the cap are affected. Federal regulations permit institutions to supplement salary subject to the salary cap using non-sponsored funds.

How does the salary cap relate to effort certification?

Ordinarily, the salary chargeable to a sponsored project is the employee's rate of pay multiplied by the employee's level of effort on the project. However, salary charged to an award subject to the salary cap cannot be paid at a rate that exceeds the capped annual rate of pay in effect. To certify the salary cap cost share, the employee needs to certify the total salary charged to the award plus the corresponding cap cost share. For example, if the employee worked 46% on the award and was subject to the salary cap, the effort card would show 37% paid effort. The employee would need to add on the 9% cap cost share and certify 46%. The calculation can be verified by clicking on the Tools tab above.

Is rebudgeting allowed with DHHS salary limitation/cap?

Yes rebudgeting is allowable. If DHHS increases the salary cap level during the life of a grant, an individual’s salary charges can be increased up to the new salary cap level, provided there are sufficient funds in the budget, and the change is within the allowable rebudgeting parameters. Please note: The sponsor will not provide additional funding to cover the difference in salary.

Should proposal budgets reflect the rates at which those subject to the salary cap will be paid?

For traditionally formatted competitive applications, actual salaries should be used in calculating salaries and preparing budgets, and should be shown on the budget form.

For streamlined applications, including NIH Modular grant proposal submissions and all non-competing (continuation) submissions, the full-time capped rate in effect when the proposal is submitted should be used for calculating salary over the cap. The Budget Justification must include a statement that the actual institutional base salary exceeds the NIH salary cap limitation. This statement will include the individual’s actual institutional base salary, appointment period and actual effort.

Are lump sum salary payments subject to the HHS salary cap?

Yes. The language in both the statute and the NIH Grants Policy Statement indicates that the limitation applies to salary paid on awards. Lump sum payments are salary and paid through salary account codes, therefore, these payments are subject to the cap.