Frequently Accessed Pages

Effort Commitments and Payroll Certification

RAMP - Frequently Asked Questions (FAQ)

No-Cost Extension Request Procedures

Extramural Support Policies and Procedures

Research Education Development (RED)

Award Statistics FY23

Total Awards

$1928M

Federal Awards

$1125M

Non-Federal Awards

$803M

Research Expenditures

8th (FY22)

Payroll Certification Frequently Asked Questions

Page Updated: Monday, June 24, 2024 2:21:37 PM CDT

Question 1: What is payroll certification?

Project-based payroll certification is UW-Madison's means of assuring compensation compliance on federally sponsored projects. Payroll certification is an after-the-fact review and attestation that the payroll charged (both direct and cost shared) to a federally sponsored project is reasonable in relation to the work performed.

Question 2: I'm a scientist working on a nonfederally-sponsored project. I used to certify my effort. Do I still need to certify my payroll?

No. Only compensation on federal or federal flow-through projects must be certified. In addition, only the project’s Principal Investigator (PI), or approved designee, is responsible for certifying payroll on their projects. These changes went into effect with the move from effort reporting to project-based payroll certification, starting with the pay period that began 12/19/2021.

Question 3: How is payroll certification completed?

Compensation for work on federal or federal flow-through projects is certified by PIs via the web-based Employee Compensation Compliance (ECC) application. ECC replaced ECRT.

Question 4: Does payroll still need to be certified twice a year?

Yes. Project payroll must be certified twice yearly. The semiannual periods of performance and their corresponding certification windows are roughly as follows:

| Period of Performance | Certification Window |

|---|---|

| January - June | August - October |

| July - December | February - April |

The period of performance start and end dates will vary from year to year because periods of performance must begin and end along with corresponding bi-weekly payroll periods.

Question 5: Are there any salary account codes excluded from certification?

Yes. The full list of account codes excluded from certification can be found here. The most common exclusions are student hourlies, lump sums, and fellow stipends.

Question 6: What does a Compensation Compliance Coordinator do?

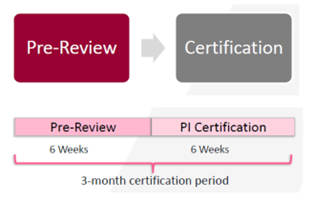

A Compensation Compliance Coordinator (CCC) plays a key role in the payroll certification process. They are responsible for pre-reviewing all project payroll statements housed in their assigned department and monitoring the certification period to assist with timely PI certifications.

Question 7: Do CCCs still review project statements after they are certified by the PI?

No. The move to payroll certification involved the implementation of a "Pre-Review Period." Instead of reviewing statements AFTER certification, coordinators review statements for accuracy before they are routed to PIs for certification.

Question 8: I'm a CCC. What should I be looking for during Pre-Review?

Pre-review should be a "good faith" review based on your knowledge of the project at the time. Some questions to ask yourself during review:

- Do all employees paid from the project (direct or cost shared) for the period of performance appear on the statement?

- Is there a variance between the expected amount and actual amount charged?

- Is anyone being charged to the project that you did not anticipate?

- Is anyone missing from the statement whose payroll should have been charged?

Question 9: Are there still consequences for late certifications?

Yes. To protect the interests of UW-Madison and ensure compliance with federal policies, the University still has consequences for failing to certify payroll in a timely manner and complete the mandatory certifier training. Consequences can be administrative or fiscal. The policy surrounding these consequences can be found here.

Question 10: The certification period has closed, and I need to do a salary transfer. Is this allowed?

Yes, in certain cases. Salary changes for those over the DHHS salary cap are NOT allowed after a certification period has closed. Changes may be allowed for other individuals, however. Once the last day of the certification window has passed, a subsequent recertification can call into question the reliability of the certification process. Therefore, any subsequent recertification request requires justification that clearly sets forth why the previous statement was erroneously certified and why the requested change is more appropriate. These requests are then reviewed by RSP leadership.

Reach out to ecc@rsp.wisc.edu to find out if a written request is required and what needs to be included in it.

Question 11: Where can I go if I have more questions?

For questions regarding payroll certification, or ECC, please contact ecc@rsp.wisc.edu.